Medicare FastTrack by OneStop Health Brokers

Learn the Secrets of Medicare in Minutes — No BS Guide Designed for People Turning 65

When should I enroll in Medicare?

Your Initial Enrollment Period starts three months before your 65th birthday and ends three months after. Enrolling during this seven-month window helps avoid late enrollment penalties. If you’re still working and have employer coverage, you may delay enrollment, but it’s critical to understand your options to avoid gaps in coverage.

Why should I learn more about Medicare now?

Understanding Medicare before you turn 65 helps you make informed decisions to avoid costly mistakes, like missing enrollment deadlines or choosing a plan that doesn’t meet your needs.

Our Medicare FastTrack service explains Medicare basics, highlights gaps, and guides you on how to cover them, ensuring you’re prepared for healthcare costs in retirement.

What does Medicare cover, and what are its gaps?

Medicare Parts A and B cover hospital stays, doctor visits, and some medical services, but they don’t cover everything. Significant gaps include prescription drugs (not covered by Parts A or B), long-term care, dental, vision, hearing aids, and most out-of-pocket costs like deductibles and copayments.

Additionally, Medicare provides limited coverage for treatments related to serious conditions like cancer, heart attack, or stroke, leaving you with potentially high costs for specialized care, medications, or follow-up treatments. These gaps can lead to substantial expenses if not addressed.

How can I cover Medicare’s gaps?

To address Medicare’s gaps, you can consider options like Medicare Advantage plans (Part C), which often include prescription drug coverage and additional benefits like dental or vision, or Medigap plans, which help pay for out-of-pocket costs not covered by Original Medicare. A Medicare Part D plan can also cover prescription drugs.

For added protection against costs from serious conditions like cancer, heart attack, or stroke, specialized plans are available to help cover treatment-related expenses. Choosing the right combination depends on your health needs and budget.

Join our Medicare FastTrack workshop to learn how to cover these gaps, and book an appointment with one of our licensed agents at OneStop Health Brokers to find the best plan for you.

Your Local, Licensed Agents

OneStop Health Brokers

Will Chandler, Principal Broker

Since 2008, Will has been a licensed insurance agent, bringing over 15 years of industry experience to his clients. He spent 12 years

working with a major insurance carrier, where he received extensive training in Medicare. This invaluable experience inspired him to start his own insurance brokerage, aiming to offer a wider range of Medicare options to better serve his clients' needs.

Will's passion for helping people and his deep understanding of the insurance landscape make him a trusted advisor for many. In his free time, he enjoys watching baseball, basketball, and football. Will's commitment to providing personalized support and his dedication to his clients' well-being truly set him apart as a very experienced agent in the field.

Jamie Gibson, Licensed Agent

Jamie was born and raised in Jeffersonville, Indiana. He spent a

small portion of his teenage years in Clearwater, Florida before

returning to Southern Indiana, where he's lived ever since. Over the

past several years, Jamie has built a strong entrepreneurial background, beginning in real estate investing, where he successfully flipped houses, before transitioning to contracting work, managing and getting his hands dirty with home renovations for clients.

In 2024, Jamie expanded his professional expertise by obtaining a

license to sell health insurance—specializing in Medicare. Drawing from years of experience in customer service, both in call centers and

running his own businesses, Jamie is known for his personable nature and conversational approach, fostering strong relationships with his

clients.

Outside of work, Jamie is an outdoor enthusiast—passionate about

hunting, fishing, camping, and off-roading in his side-by-side. Jamie's passion for helping others shines through in both his professional and personal life.

Prefer to Cut to the Chase?

Book a 1-on-1 Call Now!

Prefer In-Person?

Come See Us! Walk-Ins Are Welcome.

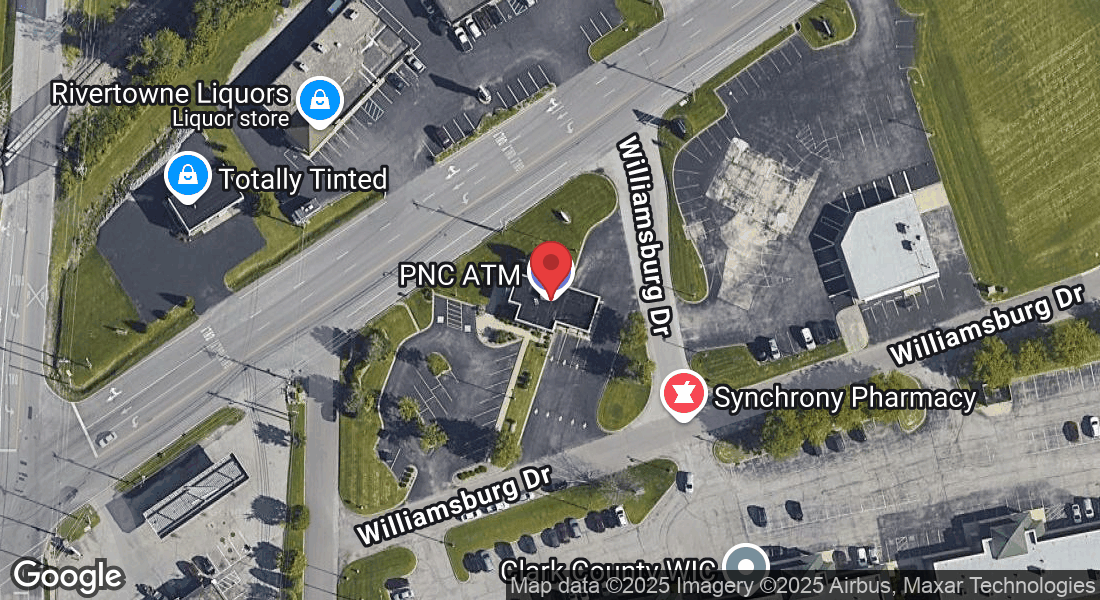

📍Office Address

1712 Charlestown New Albany Rd

Jeffersonville, IN 47130

(Old PNC Bank)